Carbon markets used to be dominated by private sectors. Today, it is seen as a public, worldwide solution to climate change. As carbon credits increase and offerings go beyond carbon-intensive industries, considerable development of the offset market is expected over the next few years. This surge forecast ignites the need for advanced, versatile, and cost-effecting trading technologies to make this revolution possible.

Over the last several years, there has been a significant reduction in pollution and greenhouse gas that was brought about by the pandemic. With global lockdowns imposed, industries such as mining, textiles, construction, and supply chain were interrupted, leading to short-term environmental benefits such as the temporary reduction of carbon dioxide and other harmful gasses. However, as the world is quickly shifting to the new normal, world leaders are now looking for long-term solutions that would help fight climate change in a global movement. The carbon market is on top of the list.

In 2019, Europe holds the highest position as having the largest global carbon market share at 51%, closely followed by North America, and Asia Pacific. Today, more countries are participating in the worldwide overhaul of making their respective nations carbon neutral. The carbon credit market is projected to reach a value of $2.4 trillion by 2027 – a massive increase from 2019’s $211.5 billion valuation. In order to support this growth prediction, a significant effort is required to enable the creation of a supportive market infrastructure.

Exberry, an Israel-based startup that helps exchange pioneers launch, pivot, break ground, and scale, has recently launched Exberry for Carbon, a turnkey solution to ignite carbon markets and fight global change.

A Blend of Exchange and Trading Technology Expertise

Exberry delivers a blend of exchange and trading technology expertise for secondary market models, combining entrepreneurial pedigree and corporate strength. Their technology and software engineering heritage combined with their strategic business counsel for growth enables them to deliver MTF and ATS grade exchange technology designed to scale and a purpose-built, end-to-end exchange infrastructure regardless of the asset class or opportunity. With Exberry for Carbon, they are able to support the launch of the timely carbon markets.

The new platform feature covers a trading user interface, permission-based trading, accounts, fees management, and settlement instructions. It supports capital market-grade trading in any kind of carbon asset and optimizes faster time to market. What’s more, it is regulation-ready, blockchain agnostic, and with a customizable UI.

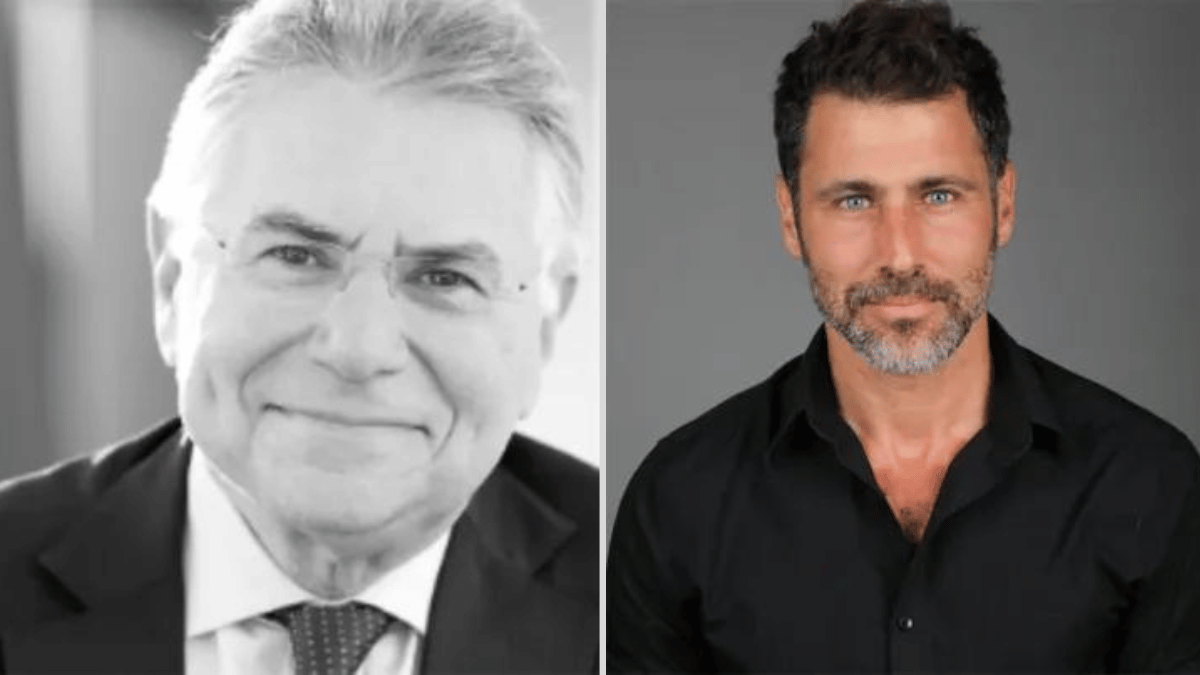

A No-Code Launch

Exberry for Carbon empowers their customers with a no-code launch of their regulated digital assets carbon marketplace within days. Yaniv Barak, Exberry’s Head of Business and Development, recognizes the surge of clients who have shown interest in participating in this movement. By building a no-code, off-the-shelf product that allows asset digitization, primary issuance, and immediate secondary trading access based on the DLT ledger, they hope to attract more partners in solidifying the global project to carbon neutrality. “We see more clients and partners entering and establishing carbon markets,” he reiterates. “At Exberry, we are big believers in regulated markets, and for that, we need to support the harmonization and standardization of the market. With our tech, partners, and know-how, we can support and accelerate this trend.” For Dr. Rene Karsenti, Advisory Board Member at Exberry, another goal is to bridge the 3 major gaps that hinder the potential of carbon markets today, from lack of standardization, insufficient regulatory and supervisory frameworks, to inefficient tech capabilities. “Transparent, regulated, harmonized, and globally interoperable carbon credit exchanges and marketplaces have the potential to unlock huge capital to fund climate change solutions alongside other funding such as green bonds in capital markets. Exberry for Carbon would contribute to this much-needed transformation,” he concludes.